Tracking Trans-Pacific Trade and Sino-US Trade Wars

- Author:Chelsea

- Source:Seabay

- Release Date:2019-09-12

Tracking Trans-Pacific Trade and Sino-US Trade Wars

During these years,America is the main market for Foreign trade company and Sunny worldwide logistics company, and Abousibly there are more trade in Amercia than the other country,all the time sea shipping from China to USA door to door serivces is our advantage sea route

At the beginning of August 2019, the United States announced that it would further increase the tariff rate on China's exports to the United States, which means that the "trade war" between the two countries will be upgraded again, and may have a negative impact on the trans-Pacific container trade. In any case, after several rounds of increased tariffs have been implemented in the two countries, trans-Pacific trade has been affected, including the impact on the total trans-Pacific container trade and the role of Asian exporting countries and regions in trans-Pacific trade.

"complex" situation

In the past year or so, the trend of trans-Pacific (eastward) container trade has changed. Supported by good US economic data in the first half of 2018, trans-Pacific (East) container trade performed well (the container trade volume on this route increased by 5% year-on-year). In the second half of 2018, the volume of trade volume accelerated to 8% year-on-year, mainly driven by “advance shipments”. After the first round of tariffs began in the third quarter of 2018, cargo owners worried that the United States might import from China in early 2019. The goods are subject to higher tariffs and are therefore eager to ship large quantities of goods to the United States before this.) Since then, container exports from Asia to North America have begun to show a relatively weak trend. In the first half of 2019, container exports were basically the same as last year (only 0.2% year-on-year). To a certain extent, this may be affected by the “advance shipment” of the two goods before the end of 2018 and the increase in tariffs. As of May 2019, about 40% of the trade volume in the Trans-Pacific (East) trade was subject to a 25% import tariff.

Different influence

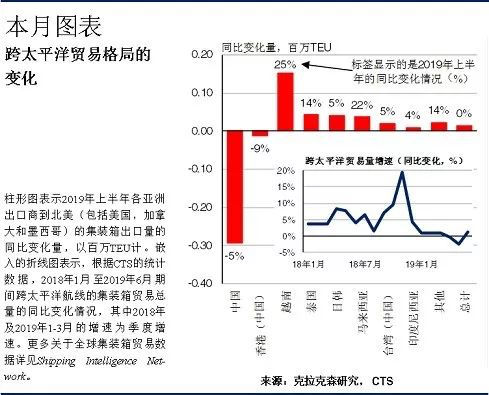

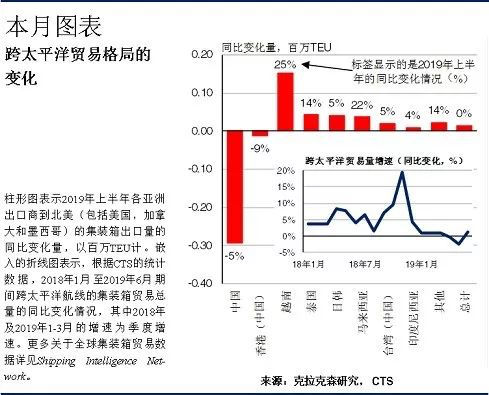

Although the total trade volume on the trans-Pacific route has remained relatively stable since the beginning of the year, the situation of Asian countries and regions exporting to the Americas has shown a distinct trend. In the first half of 2019, the number of containers exported from China to North America decreased by 290,000 TEU (down 5% year-on-year), and the number of containers exported to the United States fell by 7%. Although China is still the largest exporter to Asia in the United States, due to strong growth in container exports in other Asian regions (see chart), China’s exports accounted for 2018 in the first half of 2019 as a share of trans-Pacific (eastward) shipping. 69% of the year fell to 66%. During the same period, the number of containers exported by Vietnam grew particularly strongly, up 150,000 TEU (25%) year-on-year, while exports from Thailand and Malaysia grew very rapidly. Without a "trade war" between China and the United States, it is difficult to say how the volume of container exports in various regions will develop, but the volume of container trade in other parts of Asia seems to have replaced some of China's exports. As domestic production costs have risen, some manufacturers have moved factories from China to Southeast Asian countries in recent years. The increase in US tariffs seems to have accelerated this process to some extent. At the same time, the transformation of the manufacturing model to the “multi-regional collaboration” processing and assembly has also played a role in the growth of container trade in other Asian regions.

The challenge is still

Nonetheless, given China’s dominance in manufacturing in the region, it is difficult for other economies to fully fill this gap. On August 15, 2019, the United States announced the imposition of tariffs on approximately US$300 billion of goods imported from China (in two batches since September 1, 2019 and December 15, 2019, it is estimated that it will affect approximately 4 million TEU's trade volume) is expected to further increase the pressure on China's container exports. In particular, on August 28th, the United States once again announced that from September 1st, the tariffs on the US$300 million worth of Chinese exports to the United States will be increased from 10% to 15%.

Therefore, the Sino-US “trade war” is directly affecting the trans-Pacific (eastward) container trade, including the total trade volume and the role of Asian exporting countries and regions (and substitutes) in trans-Pacific trade. Trade between the 2019 and 2020 trans-Pacific (East) routes is expected to decline, and both carriers and ship owners are eager to find any signs of a easing of trade tensions.

In the past year or so, the trend of trans-Pacific (eastward) container trade has changed. Supported by good US economic data in the first half of 2018, trans-Pacific (East) container trade performed well (the container trade volume on this route increased by 5% year-on-year). In the second half of 2018, the volume of trade volume accelerated to 8% year-on-year, mainly driven by “advance shipments”. After the first round of tariffs began in the third quarter of 2018, cargo owners worried that the United States might import from China in early 2019. The goods are subject to higher tariffs and are therefore eager to ship large quantities of goods to the United States before this.) Since then, container exports from Asia to North America have begun to show a relatively weak trend. In the first half of 2019, container exports were basically the same as last year (only 0.2% year-on-year). To a certain extent, this may be affected by the “advance shipment” of the two goods before the end of 2018 and the increase in tariffs. As of May 2019, about 40% of the trade volume in the Trans-Pacific (East) trade was subject to a 25% import tariff.

Although the total trade volume on the trans-Pacific route has remained relatively stable since the beginning of the year, the situation of Asian countries and regions exporting to the Americas has shown a distinct trend. In the first half of 2019, the number of containers exported from China to North America decreased by 290,000 TEU (down 5% year-on-year), and the number of containers exported to the United States fell by 7%. Although China is still the largest exporter to Asia in the United States, due to strong growth in container exports in other Asian regions (see chart), China’s exports accounted for 2018 in the first half of 2019 as a share of trans-Pacific (eastward) shipping. 69% of the year fell to 66%. During the same period, the number of containers exported by Vietnam grew particularly strongly, up 150,000 TEU (25%) year-on-year, while exports from Thailand and Malaysia grew very rapidly. Without a "trade war" between China and the United States, it is difficult to say how the volume of container exports in various regions will develop, but the volume of container trade in other parts of Asia seems to have replaced some of China's exports. As domestic production costs have risen, some manufacturers have moved factories from China to Southeast Asian countries in recent years. The increase in US tariffs seems to have accelerated this process to some extent. At the same time, the transformation of the manufacturing model to the “multi-regional collaboration” processing and assembly has also played a role in the growth of container trade in other Asian regions.

The challenge is still

Nonetheless, given China’s dominance in manufacturing in the region, it is difficult for other economies to fully fill this gap. On August 15, 2019, the United States announced the imposition of tariffs on approximately US$300 billion of goods imported from China (in two batches since September 1, 2019 and December 15, 2019, it is estimated that it will affect approximately 4 million TEU's trade volume) is expected to further increase the pressure on China's container exports. In particular, on August 28th, the United States once again announced that from September 1st, the tariffs on the US$300 million worth of Chinese exports to the United States will be increased from 10% to 15%.

Therefore, the Sino-US “trade war” is directly affecting the trans-Pacific (eastward) container trade, including the total trade volume and the role of Asian exporting countries and regions (and substitutes) in trans-Pacific trade. Trade between the 2019 and 2020 trans-Pacific (East) routes is expected to decline, and both carriers and ship owners are eager to find any signs of a easing of trade tensions.