Bangladesh's letter of credit major risk tips Export Bangladesh foreign trade freight forwarding

- Author:Jim

- Source:Search network

- Release Date:2019-01-22

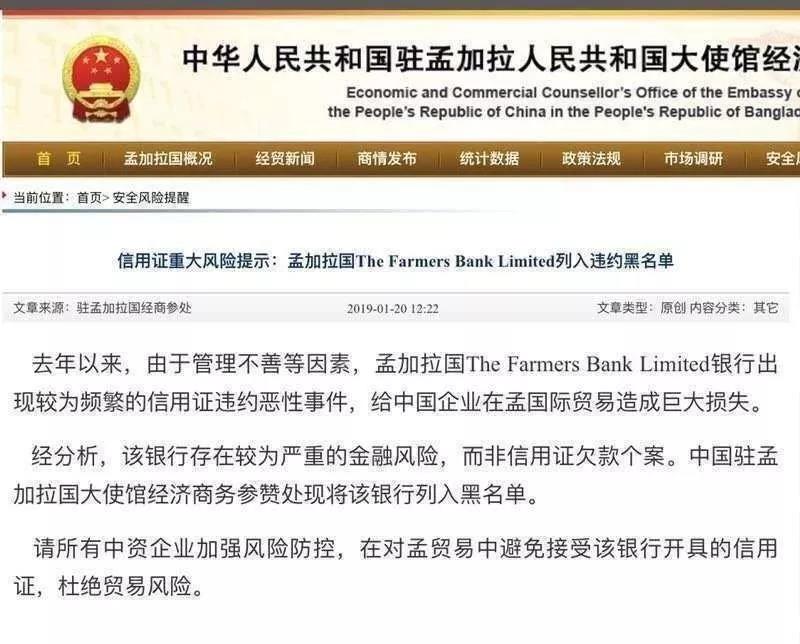

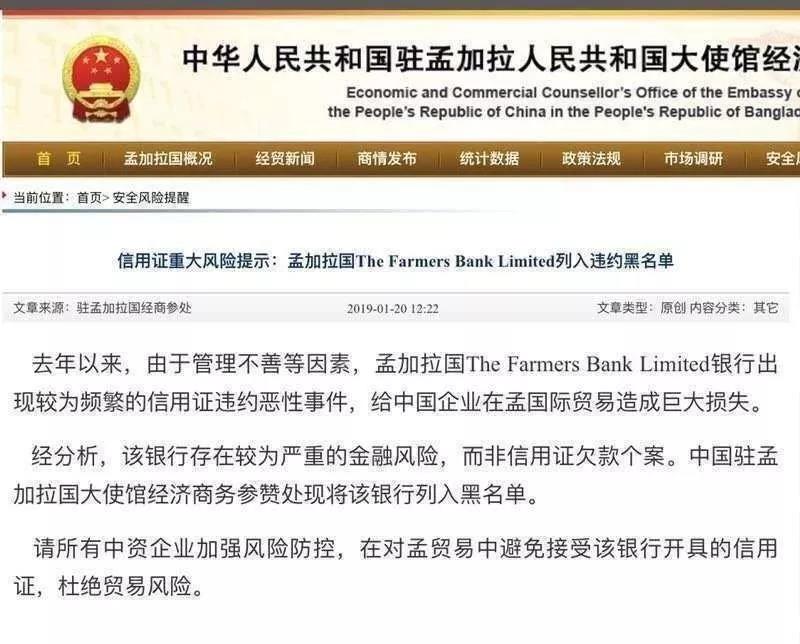

According to the Ministry of Commerce, since last year, due to poor management and other factors, the Farmers Bank of Bangladesh has seen a relatively frequent credit card breach of contract, which has caused huge losses to Chinese companies in the international trade of Bangladesh.

On January 20, 2019, the Economic and Commercial Counsellor's Office of the Chinese Embassy in Bangladesh issued a security risk reminder on the official website, officially blacklisting the bank.

On January 20, 2019, the Economic and Commercial Counsellor's Office of the Chinese Embassy in Bangladesh issued a security risk reminder on the official website, officially blacklisting the bank.

▲Notice from the Ministry of Commerce

After analysis, the bank has a relatively serious financial risk, not a case of arrears of credit. The Economic and Commercial Counsellor’s Office of the Chinese Embassy in Bangladesh is now blacklisting the bank.

All Chinese-funded enterprises are required to strengthen risk prevention and control, avoid accepting the letter of credit issued by the bank in the trade with Bangladesh, and eliminate trade risks.

After analysis, the bank has a relatively serious financial risk, not a case of arrears of credit. The Economic and Commercial Counsellor’s Office of the Chinese Embassy in Bangladesh is now blacklisting the bank.

All Chinese-funded enterprises are required to strengthen risk prevention and control, avoid accepting the letter of credit issued by the bank in the trade with Bangladesh, and eliminate trade risks.

According to the relevant regulations of Bangladesh foreign exchange management, except for special circumstances, the external payment of import and export must generally adopt the method of bank letter of credit.

Due to the generally poor reputation of Bangladeshi commercial banks, many issuing banks operate illegally. In the case of Chinese companies exporting to Bangladesh, they often encounter delays in payment of unpaid spot letters, or If the customer does not pay for the payment, the customer will issue a quality claim to the exporter after picking up the goods or seeing the goods, forcing the exporter to lower the price and causing economic losses.

The main problems encountered in the Bangladesh Letter of Credit are:

1. After the importer picks up the goods, the bank delays the payment time without any reason, even if the negotiating bank repeatedly urges it.

2. After the bank releases the order to the importer, it does not immediately pay the purchase price, allows the importer to submit the so-called quality claim to the exporter after the delivery, forcing the exporter to discount the price, and then the negotiating bank instructs the issuing bank to deduct the discount from the payment. .

3. After the importer picks up the goods, the quality of the goods is appealed to the local court. The court informs the bank to stop the payment. The bank can not pay outside during the trial of the case, thus delaying the payment time.

4. After the customer accepts the discrepancy, the bank still does not pay the purchase price.

If there is a discrepancy in the document, the market price at that time falls, and some customers refuse to pay the bill, or take the opportunity to file a high claim with the exporter, forcing the exporter to cut the price, thus suffering a large economic loss. After the bank returns the order, the handling of the goods is very difficult.

The return and transfer of the goods must be handled with the consent of the original customer. The procedures are cumbersome, and the customers generally do not adopt a cooperative attitude. Therefore, there are very few cases of returning the goods. Even if the goods are returned, the losses are very serious.

According to the Bangladesh Customs regulations, the goods are stranded in the port for more than 3 months (45 days for fruits and vegetables) and will not be cleared. The goods will be auctioned by the customs and the auction proceeds will be turned over to the state treasury.

Due to the generally poor reputation of Bangladeshi commercial banks, many issuing banks operate illegally. In the case of Chinese companies exporting to Bangladesh, they often encounter delays in payment of unpaid spot letters, or If the customer does not pay for the payment, the customer will issue a quality claim to the exporter after picking up the goods or seeing the goods, forcing the exporter to lower the price and causing economic losses.

The main problems encountered in the Bangladesh Letter of Credit are:

1. After the importer picks up the goods, the bank delays the payment time without any reason, even if the negotiating bank repeatedly urges it.

2. After the bank releases the order to the importer, it does not immediately pay the purchase price, allows the importer to submit the so-called quality claim to the exporter after the delivery, forcing the exporter to discount the price, and then the negotiating bank instructs the issuing bank to deduct the discount from the payment. .

3. After the importer picks up the goods, the quality of the goods is appealed to the local court. The court informs the bank to stop the payment. The bank can not pay outside during the trial of the case, thus delaying the payment time.

4. After the customer accepts the discrepancy, the bank still does not pay the purchase price.

If there is a discrepancy in the document, the market price at that time falls, and some customers refuse to pay the bill, or take the opportunity to file a high claim with the exporter, forcing the exporter to cut the price, thus suffering a large economic loss. After the bank returns the order, the handling of the goods is very difficult.

The return and transfer of the goods must be handled with the consent of the original customer. The procedures are cumbersome, and the customers generally do not adopt a cooperative attitude. Therefore, there are very few cases of returning the goods. Even if the goods are returned, the losses are very serious.

According to the Bangladesh Customs regulations, the goods are stranded in the port for more than 3 months (45 days for fruits and vegetables) and will not be cleared. The goods will be auctioned by the customs and the auction proceeds will be turned over to the state treasury.