BIMCO: Trade tensions are delayed, economic growth is slowing, global trade volume is frustrated

- Author:Hank

- Source:Xinde Maritime

- Release Date:2019-06-19

We are doingFreight forwardingThe industry has a lot to do with the economic environment of the whole world. In the face of this complicated environment, the only constant is to continuously change innovation. Continue to expand your business capabilities, create benefits for customers, and make the best logistics solutions.

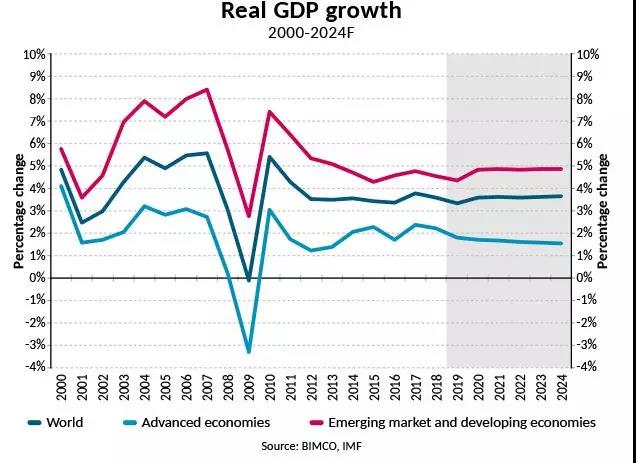

The slowdown in growth in developed economies is particularly acute for global trade. According to IMF data, growth in developed economies is expected to slow from 2.2% in 2018 to 1.8% in 2019 and 1.7% in 2020. Trade in developed economies has the highest multiplier to GDP. Although emerging economies are expected to increase by 4.4% in 2019, the slowdown in developed economies has led to a faster decline in global trade, leading to a decline in overall trade growth.

The Eurozone manufacturing PMI has been shrinking since February. It reached 47.9 in April, close to 47.5 in the previous month, which is the lowest point in six years. The data for the Eurozone countries vary widely, with Greece ranking first with 56.6, reaching its highest level in nearly 19 years, while Germany was at the bottom with 44.4. Germany is Europe's export engine, so this recession is not very optimistic.

Due to its dependence on exports, Germany has been hit hard by the global economic slowdown, and demand from other countries, especially China, for its products has plummeted. Misfortunes are not alone, Germany has also been affected by trade tensions between the United States and the European Union. As Europe's largest exporter of steel and aluminum products to the United States, they now have to bear US tariffs. Other factors that seriously affect the German economy include the new regulations on vehicle emissions that interfere with the automotive supply chain.

The IMF lowered its growth forecast for Germany. In the April 2019 update, the German economy is expected to grow by 0.8% in 2019, down from 1.5% in 2018. The German government announced plans to increase infrastructure spending. It will also better support local businesses by reducing corporate taxation and reducing red tape. If the German economy is to reach the 1.4% growth rate of the International Monetary Fund in 2020, there must be a clear improvement.

Germany is not the only EU country with a slowdown in growth. The IMF predicts that Italy will increase by only 0.1% in 2019 and 1.3% in France.

The deadline for Brexit was postponed until October 31, 2019. While this eliminates the direct risks of leaving the EU without an agreement, it extends the period of uncertainty and does not guarantee a clear picture of the situation before the new deadline. Uncertainty is detrimental to business investment, and political efforts also take time, preferably to eliminate trade barriers.

Due to its dependence on exports, Germany has been hit hard by the global economic slowdown, and demand from other countries, especially China, for its products has plummeted. Misfortunes are not alone, Germany has also been affected by trade tensions between the United States and the European Union. As Europe's largest exporter of steel and aluminum products to the United States, they now have to bear US tariffs. Other factors that seriously affect the German economy include the new regulations on vehicle emissions that interfere with the automotive supply chain.

The IMF lowered its growth forecast for Germany. In the April 2019 update, the German economy is expected to grow by 0.8% in 2019, down from 1.5% in 2018. The German government announced plans to increase infrastructure spending. It will also better support local businesses by reducing corporate taxation and reducing red tape. If the German economy is to reach the 1.4% growth rate of the International Monetary Fund in 2020, there must be a clear improvement.

Germany is not the only EU country with a slowdown in growth. The IMF predicts that Italy will increase by only 0.1% in 2019 and 1.3% in France.

The deadline for Brexit was postponed until October 31, 2019. While this eliminates the direct risks of leaving the EU without an agreement, it extends the period of uncertainty and does not guarantee a clear picture of the situation before the new deadline. Uncertainty is detrimental to business investment, and political efforts also take time, preferably to eliminate trade barriers.

The flash forecast for the first quarter of 2019 is very high at 3.2% (the flash forecast is the US Bureau of Economic Analysis (BEA)'s two revisions after receiving more reliable data). Important factors for this development include personal consumption expenditures, private property investment, growth in local government spending, and a slight reduction in the trade deficit this quarter.

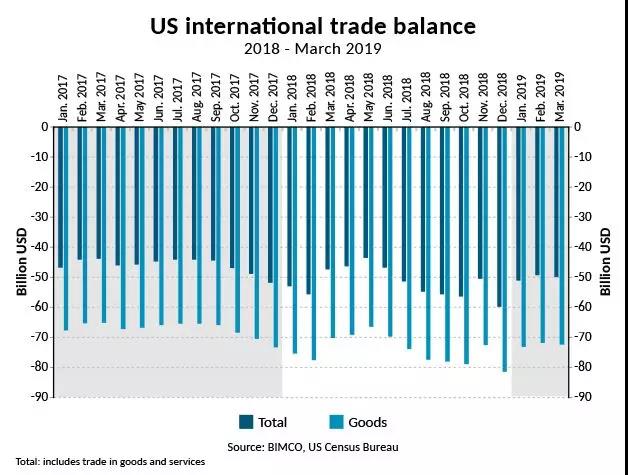

In 2018, the total US trade deficit reached a record $891.3 billion, the largest monthly trade deficit announced in December 2018 (see chart). One reason is that US buyers increased their imports in the last few months of 2018 to circumvent tariff increases on some Chinese imports that will take effect on January 1, 2019.

Since then, in the first two months of 2019, sufficient inventory in the early period has led to a decline in imports. The inventory/sales ratio increased from 1.43 in November 2018 to 1.47 in December and increased to 1.48 in February 2019. This rising ratio indicates that stocks are growing faster than sales, weakening the prospects for importing containerized goods across the Pacific trade channel.

In 2018, the total US trade deficit reached a record $891.3 billion, the largest monthly trade deficit announced in December 2018 (see chart). One reason is that US buyers increased their imports in the last few months of 2018 to circumvent tariff increases on some Chinese imports that will take effect on January 1, 2019.

Since then, in the first two months of 2019, sufficient inventory in the early period has led to a decline in imports. The inventory/sales ratio increased from 1.43 in November 2018 to 1.47 in December and increased to 1.48 in February 2019. This rising ratio indicates that stocks are growing faster than sales, weakening the prospects for importing containerized goods across the Pacific trade channel.